Tax returns delayed

Published 12:31 am Tuesday, January 31, 2012

Early tax filers expecting a quick return of tax refunds might have a bit of a wait in store.

In an email sent to tax professionals last week, the IRS warned that taxpayers who have already filed their federal taxes may receive their refunds back approximately one week later than previously thought.

The reason behind the delay is new security software. In recent years, the IRS has been criticized for the rising number of identity thefts that have been tied to tax refunds. As a response, the agency ramped up its security screening this tax season.

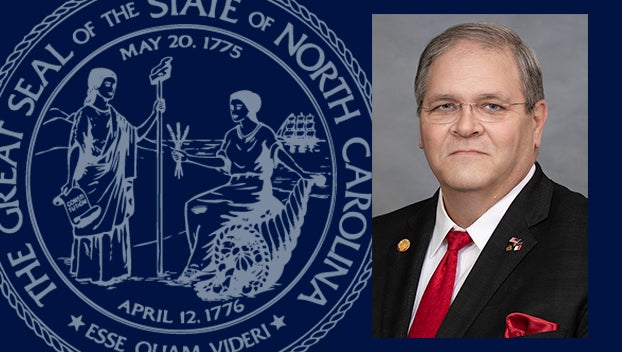

“Basically what happened is that the IRS totally changed the software,” explained Keith Kidwell, franchise owner of H & R Blocks in Beaufort County. “They modernized the system, ultimately to speed it up.”

In its early days, the new software is moderately slowing things down, however. At the start of the tax season, the IRS projected that refunds would be issued eight to 15 days after filing, but that number has since increased to 21 days.

A statement from the IRS indicated 60 percent to 70 percent of returns filed before 11 a.m. Jan. 18 could be delayed by the security measures added with the new fraud-screening process.

“It’s running a bit slower than what we’ve experienced in the past,” said Kidwell. “They’re taking a closer look at the returns to make sure it’s working correctly.”

Returns filed with the state are not affected by the federal slowdown, and Kidwell believes that once all the kinks are worked out, the system will be much faster.

“Ultimately, it will speed it up,” he said. “It will end up being a good thing, once they get all the bugs out.”

For more information on when to expect a tax refund, click on the “Where’s My Refund” link on www.irs.gov or call 1-800-829-1954.