Washington gets clean audit

Published 7:21 pm Wednesday, December 11, 2019

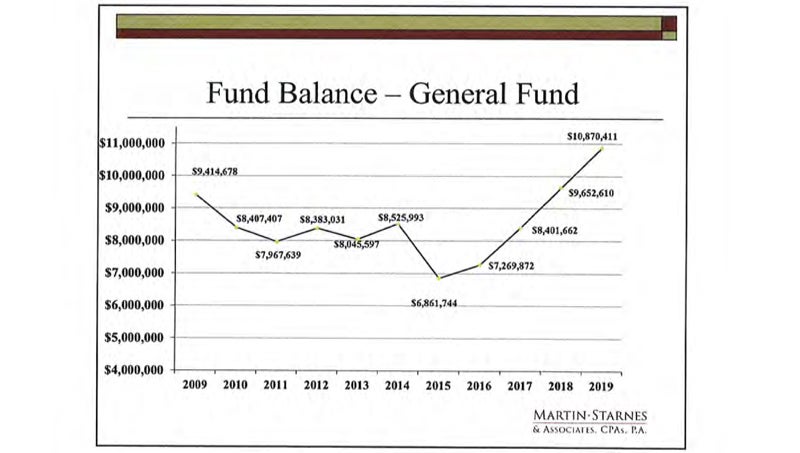

- STEADILY CLIMBING: A steady climb in Washington's fund balance leaves cash on hand to tackle significant projects. Washington City Manager Jonathan Russell says the increase is the result of a growing tax base, cost saving measures and an infusion of some gains from the city's electric fund. (City of Washington)

The City of Washington received a positive audit report for the 2018-19 fiscal year during Monday’s meeting of the Washington City Council.

The audit of the city’s financial statements for the past year showed, “No significant deficiencies or material weaknesses in internal control ” according to a Martin Starnes & Associates presentation to the board

In layman’s terms, that means the firm found nothing out of the ordinary with the city’s finances and no issues with the city’s internal financial oversight.

“It was a clean audit, with no findings of any weakness,” said City Manager Jonathan Russell. “We were happy to see that. With just a review of our internal processes, everything seemed to be sound with that.”

Total general fund revenues for the fiscal year came out to $12,333,845, compared to $12,139,520 in expenses. Property taxes and other taxes made up the lion’s share of revenues, while public safety was the No.1 expense, making up 51% of the city’s expenditures.

For the past five years, the city’s fund balance has been on a steady, upward trajectory, from $6.8 million at the end of 2014-15 to $10.8 million at the end of 2018-19.

Under state statute, approximately $2.1 million of that amount is not spendable and must be kept for contingency purposes. That leaves approximately $8 million in the bank that can be spent at the city’s discretion for any number of projects.

“We’ve done a good job of cutting expenditures to allow for additional available funds,” Russell said. “Also, we’ve had some residential and commercial growth in the city that has increased property tax collection.”

Another factor that has contributed to the growth of the fund balance is a continuing pattern of transfers from the city’s electric fund to its general fund.

Under state law, the city is allowed to transfer a certain amount of revenue from its electric utilities fund for a few specific reasons. One is to cover costs related to operating the electric system. The city can also transfer up to 3% of the electric system’s gross capital assets or 5% of the system’s gross annual revenue to the general fund as a return on investment for operating the system.

“There is some correlation to that, as far as increasing the fund balance,” Russell said. “We’ve realized some gains through cost saving measures, but there is a direct correlation there. ”

Russell said that a continuing trend of growth in both the residential and commercial tax bases will likely prevent any need to change the city’s property tax rate in coming years.

Another high note in the audit was the continuing reduction of the city’s debt service. At the end of the 2018 fiscal year, Washington had an outstanding debt of $204,337, whereas the outstanding debt at the end of the 2019 fiscal year was reduced to $170,584.

“It’s being fiscally conservative, but it is tied to the pay-as-you-go philosophy,” Russell said. “There’s been very little borrowing for the past 8-to-10 years.”

A copy of the audit is available for public review at www.washingtonnc.gov.