No new taxes, same services in county’s recommended budget

Published 7:29 pm Wednesday, May 15, 2019

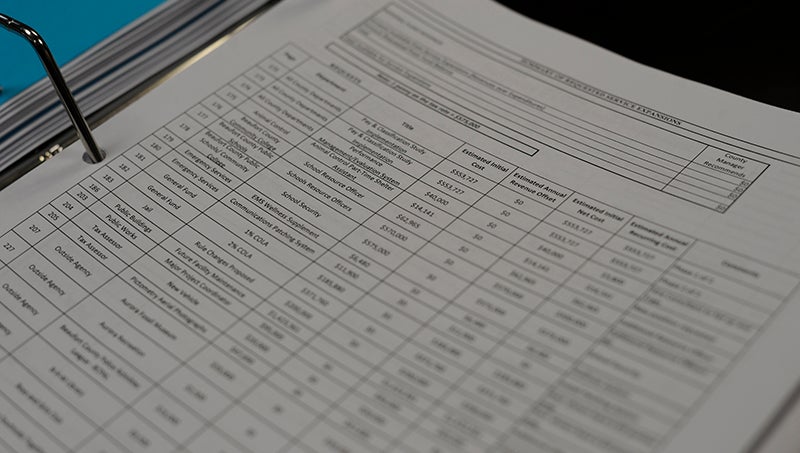

- (Vail Stewart Rumley/Daily News)

Property taxes remain the same in the budget proposed for Beaufort County for 2019-20.

County Manager Brian Alligood presented the recommended annual budget to county commissioners earlier this week.

County commissioners will tweak the budget over the coming weeks through a series of budget work session in May. The public will be able to comment on the proposed budget at a public hearing set for the Board of Commissioners regular meeting, scheduled June 3.

- The overview of the 2019-20 recommended budget includes:

- After last year’s 6-cent per $100 valuation increase in the county ad valorem tax rate, the current 61.5 cents per $100 will remain the same, generating approximately $34.8 million in revenue.

- All county services and programs offered in the prior year’s budget are maintained.

- The recommended general fund budget for 2019-20 is $58,421,874, which is 1.2% more than the prior year’s original budget.

- The public school system is funded at the same level as the prior year. As the school system budget request was turned in on May 9, after the recommended budget had been completed, any additional funding will have to be determined by the board during budget work sessions.

- The county payroll system will get a change in that employees will be paid every two weeks instead of on the 15th day and last day of the month, eliminating the adjustment between what an employee is paid and what the time actually worked, as well as allowing overtime to be paid in the next pay period, as opposed to the next month.

- Fire and EMS tax rates remain the same in all districts in the county.

- Solid waste fees will be increased by $10 to offset the costs of increasing solid waste tonnage (the county is charge on a per ton basis), as well as pay debt service on the Ransomville convenience site renovation.

- Water rates will increase by 3%, part of a long-term funding plan pass by the Board in 2018-19.

- An appropriation of $85,000 from the General Fund fund balance is proposed to pay for one-time costs of a replacement of the telephone system in the Beaufort County Sheriff’s Office and a broadband engineering study of the county.

The budget process started in January, budget requests from county departments and outside agencies were returned to the county finance department in early March, and the recommended budget finalized after a full review of revenues, expenditures and projected fund balance — a process delayed until the first week of May because property tax information is not available until late April, according to the budget.

With an effective tax rate of $0.6187, Beaufort County ranks the 44th-lowest among of all North Carolina county tax rates. Compared to surrounding counties, Beaufort County taxes are lower than all but two — Pamlico County, which has a $.5781 effective tax rate, and Craven County, a $0.5257 effective tax rate — with Martin County ranking at $0.8677; Washington County at $0.8653; Hyde County at $0.6985; and Pitt County at $0.6727.