Auditor says Washington is financially sound

Published 7:54 pm Thursday, February 11, 2021

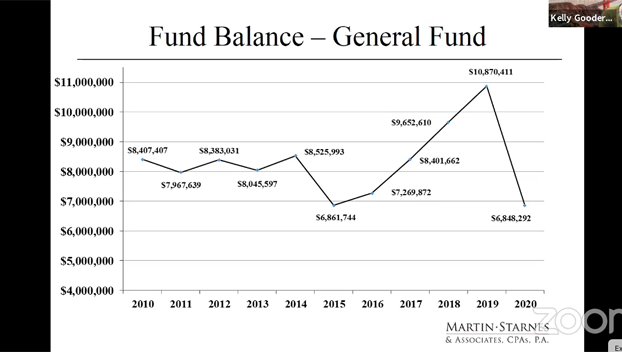

- DATA: This graph from Martin Starnes and Associates shows how Washington’s general fund balance has fluctuated over the past 10 years. Several large projects caused the general fund balance to drop by approximately $4 million in the fiscal year 2019-20. (Martin Starnes and Asssociates)

|

Getting your Trinity Audio player ready...

|

Kelly Gooderham, audit director at the accounting firm Martin Starnes and Associates presented Washington’s audit report for the fiscal year 2019-20 to City Council on Tuesday. At the end of her presentation, Mayor Donald Sadler asked Gooderham if the city was financially sound.

“You definitely have a lot of projects going on that are going to be for the betterment of the city, so I would say so,” Gooderham replied.

The city’s general fund balance decreased by approximately $4 million from the previous fiscal year. That drop was largely due to expenditures for several large projects, such as the streetscape project, which cost the city roughly $2 million; a new police station, which cost the city approximately $1 million; and renovations to the Washington-Warren Airport, which cost the city approximately $500,000.

The city’s general fund revenues decreased by $721,845, or 6%, in comparison to the previous fiscal year, a drop Gooderham attributed to FEMA revenues that were received in the prior year, as well as a drop in sales tax and occupancy tax revenues during the COVID-19 pandemic.

Meanwhile, the city’s general fund expenditures rose by about $1.4 million, or 10%, due to salary increases as well as jumps in “contracted and professional services expenditures.”

The decrease in fund balance and increase in expenditures contributed to an approximately $5.7 million drop in the city’s available general fund balance — which is what remains after the restricted fund balance is removed from the equation. At the end of the fiscal year 2019-2020, Washington’s available fund balance ($2.9 million) was 16.67% of the city’s expenditures and transfers out; it was 67% at the end of the fiscal year 2018-19.

Per the audit report, Washington received $4,593,630 in ad valorem tax revenue, a small drop of less than $4,500 from the year prior. The highest percentage of general fund revenues came from ad valorem taxes (40%), other taxes and licenses (26%), unrestricted intergovernmental funds (18%), and “other revenues,” a category that includes restricted intergovernmental funds, permits and fees, sales and services, investment earnings and miscellaneous revenue (16%),

The categories accounting for the highest general fund expenditures were public safety (49%), cultural and recreation (18%), general government (17%) and other expenditures (16%).

Washington’s water fund ended the fiscal year at a net loss of $65,821, the sewer fund incurred a net loss of $162,756, the electric fund incurred a loss of $4,291,273, and the stormwater fund incurred a loss of $176,456. The city’s airport fund ended the year at a net income of $69,513. The non-major funds, solid waste and cemetery, incurred a combined loss of $176,722. Much of the losses those funds incurred were due to money being transferred out. The electric fund, for instance, brought in $1,716,837, but the city transferred $6,008,110 out of that same account.

In terms of the amount of available money each enterprise fund had as a percentage of their respective operating expenses, the water fund was at 154% at the end of 2019-20, an increase of three percentage points over the previous fiscal year. The sewer fund was at 81%, a decrease of six percentage points; the electric fund was at 51%, a decrease of three percentage points; the stormwater fund was at 109%, a decrease of 27 percentage points; the airport fund rose from 1% in the previous fiscal year to 54% in 2019-20; and the non-major funds dropped from 55% to 39%.

“I think it’s worth noting that in this past year we’ve completed large projects, with the streetscape project,” City Manager Jonathan Russell said. “We have allocated funding to move forward with our new police station site, as well as the paving project that took place at the airport — and then some smaller things with parks and recreation.”